Not many traders, apparently. Sentiment has been low for most of 2012, never even once reaching 50% bulls according to DSI. The latest slump has made futures traders extremely bearish on the beans for three weeks now, but in the first half of 2012 we saw this condition sustained for longer than I’ve ever witnessed on a contract. Despite a preponderance of bears, the price continued to slide, even at an accelerated pace, before a small rally this summer. Prices and sentiment have since returned to their lows.

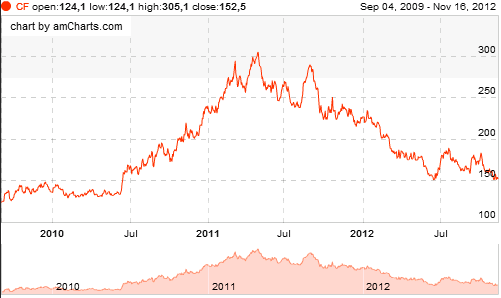

Daily close, cents per pound:

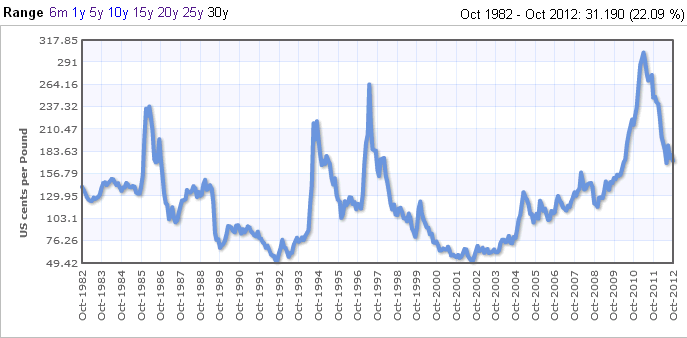

Despite all of this bearishness and a 50% decline, coffee is still not particularly cheap by historical standards. It has been working off a mania that resulted in a parabolic doubling in 10 months from summer 2010 to spring 2011. I can’t publish the data, but picture bullishness alternating from medium-high to very high for the duration of that rally. This probably goes a long ways towards explaining the steady decline and bearishness. Prices have now returned to the base of that ramp, but if we look at a long-term chart, we can see that the spike was the final blowoff of a bull market coinciding with the general commodity boom, and that today’s price is still triple the 2001 lows. Commodities are cyclical and tend to swing from extreme to extreme, adjusted for inflation, so coffee wouldn’t be historically cheap today unless it were under $1.00/lb.

Monthly close (through Oct):

Indexmundi.com

I don’t see any great opportunity in coffee either way at present. It just makes an interesting study in herding behavior.

BTW, has anyone else noticed that retail bean prices at fancy grocery stores increased from the $7-10 range to the $10-13 range a couple of years ago? This coincided with the futures spike, but the correction hasn’t been passed on to consumers. Some players in the supply chain are likely enjoying fatter than usual margins.