For those unfamiliar with John Hussman, I cannot offer high enough praise of this mutual fund manager for his prudent, long-term style of equity investing, and his actionable financial market and economic research. The man uses statistics better than anyone else I’m aware of in finance.

Lately, he has been making a strong case that the US entered recession in 2012, as shown by those indicators that, when viewed as a group, have a strong record of appearing at the start of recessions, and only at such times.

From his weekly market commentary:

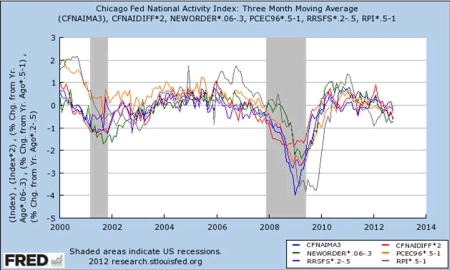

While we continue to observe some noise and dispersion in various month-to-month economic reports, the growth courses of production, consumption, sales, income and new order activity remain relatively indistinguishable from what we observed at the start of the past two recessions. The chart below presents the Chicago Fed National Activity Index (3 month average), the CFNAI Diffusion Index (the percentage of respondents reporting improvement in conditions, less those reporting deterioration, plus half of those reporting unchanged conditions), and the year-over-year growth rates of new orders for capital goods excluding aircraft, real personal consumption, real retail and food service sales, and real personal income. All values are scaled in order to compare them on a single axis.

Readers are strongly encouraged to read this week’s commentary in full and to browse Hussman’s archive here.