Sentiment and price action are extreme. Combined, they make a very strong case for a rebound.

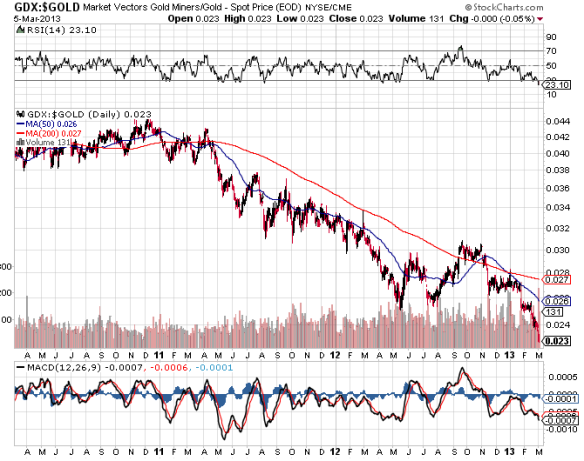

Gold stocks are also very cheap relative to the broad indices, as well as gold itself (which is also the most under-loved since it was $300 per ounce).

Images from stockcharts.com

Gold itself is still very expensive relative to other hard assets and financial assets on an historical basis, but trader sentiment is bleak, a contrary indicator. From 2001 to the top in 2011, we never had such a long down streak on such bearishness, which may indicate, despite its short-term bullish implications, that the bull market may have topped at $1920 per- in August 2011. We had parabolic moves on extreme bullishness in gold (peaking 8.11), silver (5.11) and platinum (3.08), and moves like that tend to burn up all reserves of excitement and mark tops for years to come.