Traders are again very bearish on the Japanese Yen, just as they were back in March 2012, prior to its 8% rally against the USD. JPY/USD is also getting very oversold, as shown by RSI on a weekly chart.

The daily chart is showing a positive divergence in RSI, a bullish sign:

However, a glance at the monthly chart shows a major break of the uptrend since 2007, as well as a deterioration in RSI (diverting downward over the last 18 months).

Traders are more bearish now than in March, but this condition has not yet been sustained for long enough to give the buy signal we had then. Also, I believe the yen may putting in a long-term top, due to the trendline break as well as developing trend of lower lows and lower highs in sentiment readings. Any multi-week rally that may be setting up should be viewed in that context, perhaps as an opportunity for entering a short position.

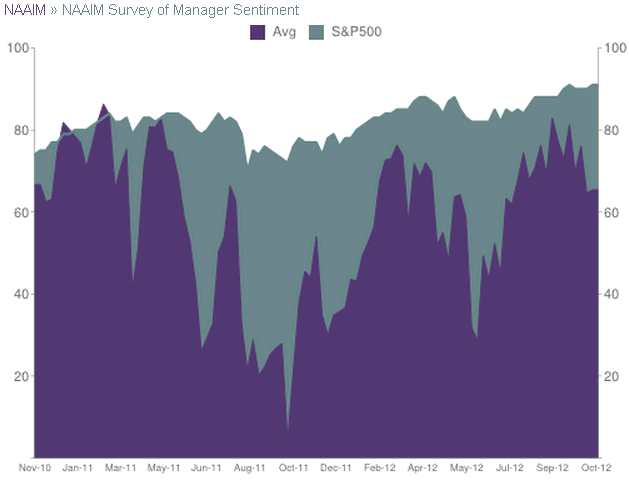

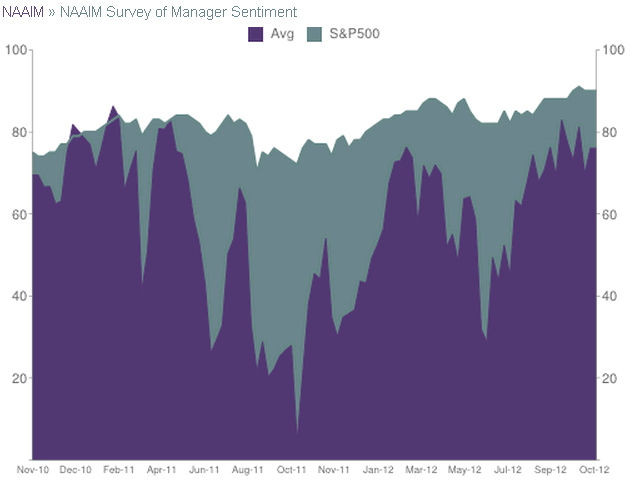

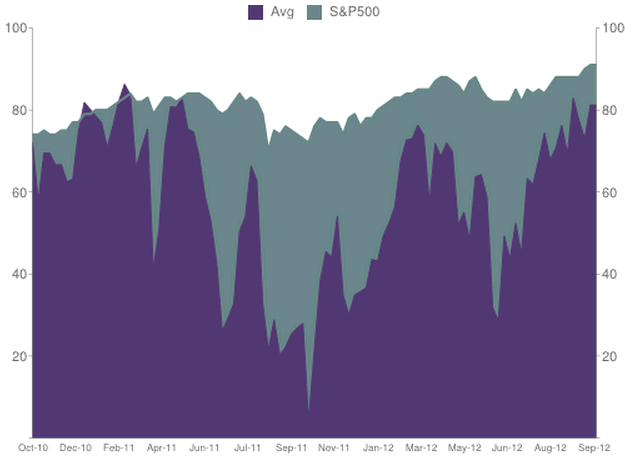

That said, a yen rally would fit into the global context of a nascent US recession and top in equities, as the yen and dollar have been safe-haven trades along with government bonds from the US, Japan, Germany and UK, among others. Sentiment on US equities has rebounded sharply since mid-November, when it reached oversold territory by some measures. Equity sentiment is not elevated, but if we are entering a bear market it need not become elevated before deteriorating again (a trend of lower lows and lower highs in sentiment was observed in 2007-2008).

One other interesting piece of data here is that Nikkei sentiment has been on the low side since mid-2011. Sometimes the yen and Nikkei have a strong negative relationship, other times positive, so I don’t know how this fits into things, unless Japan is finally going to reflate after 20 years of a bear market in stocks and strong currency and bond markets. We may indeed be at such an inflection point. I would certainly rather buy and hold Japanese equities than bonds here.